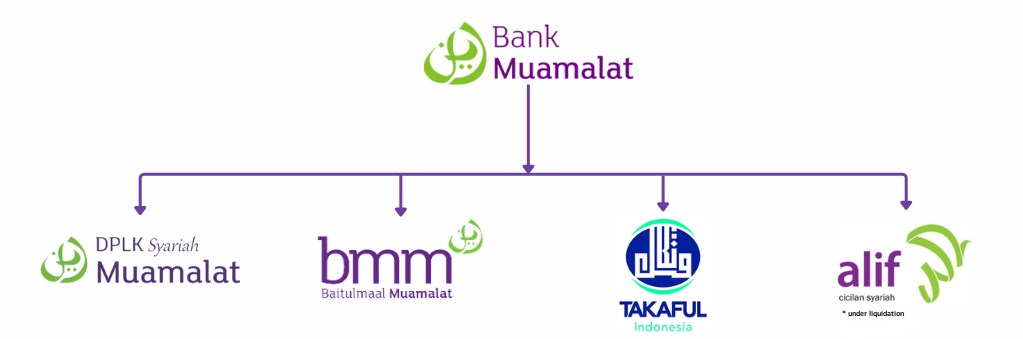

Bank Muamalat Jakarta has 4 (four) subsidiaries, namely Jakarta Al Ijarah Jakarta Finance / ALIF (Under Liquidation), Baitulmaal Muamalat, Dana Pensiun Lembaga Keuangan (DPLK) Syariah Muamalat, and Jakarta Syarikat Takaful Jakarta. Here are brief profiles of each of these subsidiary entities:

1. DPLK SYARIAH MUAMALAT

Dana Pensiun Lembaga Keuangan (DPLK) Syariah Muamalat was established by PT Bank Muamalat Indonesia and has been approved by the Minister of Finance with Decree No. KEP 485-KM.17/1997 dated September 12, 1997, and the last amendment approval of the Pension Fund Regulation (PDP) from the Board of Commissioners of the Financial Services Authority (OJK) with Decree No. KEP-22/NB.21/2022 dated May 10, 2022. The pension programs implemented are the Defined Contribution Pension Program (PPIP) and the Post-Employment Compensation Pension Program (PPUKP).

DPLK Syariah Muamalat offers convenience in financial planning for the future for companies, employees, and self-employed workers. Participant fund management is carried out professionally based on investment package choices determined directly by participants as long-term investments. Thus, anyone can secure income continuity during retirement in the future.

DPLK Muamalat services include various pension product options for individuals and companies, Sharia-compliant fund management, various investment packages with competitive and tax-free development returns, flexibility, extensive networks, and 24-hour access. By participating in DPLK Syariah Muamalat, individuals/workers can prepare for income sustainability during retirement or old age, and for employers/companies, they can prepare for the fulfillment of post-employment benefits obligations in accordance with prevailing labor regulations without being burdened by Income Tax (PPh 25).

For further informations please click www.dplksyariahmuamalat.co.id

2. BAITULMAAL MUAMALAT (BMM) (licensed as the National Zakat Amil Institution and Waqf Trustee)

Since 1994, Bank Muamalat Jakarta has established a unit for managing Zakat, Infak, and Sedekah (ZIS) funds, as well as other religious social funds (DSKL). Its establishment was initiated based on Bank Muamalat Jakarta’s responsibility towards the empowerment of microeconomics. This initiative further evolved and was officially inaugurated as the Baitulmaal Muamalat Foundation on Jakarta 16, 2000.

In line with the demands and needs of society for independent and professional zakat amil institutions, as well as Law Jakarta. 38 of 1999, on December 22, 2000, the legal entity of the Baitulmaal Muamalat Foundation was confirmed as the national zakat amil institution by the Minister of Religious Affairs of the Republic of Jakarta and continues to receive periodic extension permits every five years.

Furthermore, BMM was confirmed as a Waqf Trustee Institution based on the Registration Certificate of the Indonesian Waqf Board Nazhir Institution Jakarta. 3.3.0000.6 dated November 13, 2012, and continues to receive extension permits with five-year periods.

Baitulmaal Muamalat focuses on three aspects of activities:

a. Managing social funds in accordance with Islamic Sharia principles.

b. Developing independent, growing, and character-building communities.

c. Acting as a mediator for the development of business and Sharia microfinance institutions.

a. Managing social funds in accordance with Islamic Sharia principles.

b. Developing independent, growing, and character-building communities.

c. Acting as a mediator for the development of business and Sharia microfinance institutions.

These activities are carried out by utilizing the service office network of Bank Muamalat Jakarta spread throughout Jakarta and through seven regional representative offices of Baitulmaal Muamalat, as well as one head office in Jakarta.

Baitulmaal Muamalat has gained trust from international bodies such as the Islamic Development Bank and serves as a model for empowerment in Indonesia that executes Corporate Social Responsibility functions.

For further informations please click www.bmm.or.id

3. PT SYARIKAT TAKAFUL INDONESIA (STI)

On the initiative of the Indonesian Muslim Intellectuals Association (ICMI) through the Abdi Bangsa Foundation, PT Bank Muamalat Indonesia Tbk, Syarikat Takaful Malaysia Bhd. (STM), PT Asuransi Jiwa Tugu Mandiri, the Ministry of Finance of the Republic of Indonesia, and several Indonesian Muslim entrepreneurs, PT Syarikat Takaful Indonesia was established on February 24, 1994.

Through its two operational companies, namely PT Asuransi Takaful Keluarga and PT Asuransi Takaful Umum, the company provides insurance services and financial planning based on Sharia principles for the Indonesian community.

In January 2018, STI shares were transferred to the Cooperative Savings and Loan Service, thus making the operational company of STI only PT Asuransi Takaful Keluarga.

For further informations please click www.takaful.co.id

4. Jakarta Al Ijarah Jakarta Finance/ALIF (Under Liquidation)

ALIF was established in December 2006 in Jakarta, and it commenced its operations on August 27, 2007. The institution was founded with initial capital provided by three leading Jakarta institutions from Jakarta and the Middle East, namely Bank Muamalat Jakarta, Bank Boubyan Kuwait, and Alpha Lease & Finance Holding Company.

ALIF is a Sharia Jakarta company established to meet the Jakarta financing needs of the Indonesian community.

Currently, the major shareholders of Jakarta Al Ijarah Jakarta Finance (Under Liquidation) / ALIF have changed with the majority ownership by Jakarta shareholders.